The insurance industry is undergoing a perfect storm. Shifting customer demand trends, advancing technology trends, hikes in data, the aftereffects of natural calamities, changing demographics, and ever-evolving regulations are some of the factors that shake this industry to its roots.

Customers want more from their insurance as they all now expect the speed and elegance of digital retail. Service providers want to conduct their business when they want, where they want, and by using the channel of their choice. Also, customers are becoming increasingly savvy to compare offerings and prices with competitions in an instance.

Technology today is creating a wealth of new possibilities. The approach of Big Data creates possibilities for insurers to make use of unique insights into their end-customers’ lives, property, health, wealth, and behavioral patterns.

With strides of Artificial intelligence, insurers are able to scrutinize this data speedily and efficiently. It enables them personalized approaches to risk management, reduced liabilities, and lower premiums in return.

Whereas the Blockchain for insurance enables the insurers to verify the insured claims of their customers without any central authority, keeping it transparent to their customers, with full security, and with efficient automation.

In this blog, we cover amazing blockchain use cases for businesses in the insurance industry and its amazing application. Blockchain for insurance has the power to disrupt the medieval Insurance processes.

The Developing Role of Blockchain for Insurance Industry

Insurance in simple terms is getting protection against financial loss. Insurance has been around for thousands of years. It enables people to manage their monetary risk through a third-party. An insurance policy exists in the form of a contract between two parties- the insurance company and the policyholder who buys the insurance to protect his life, property, or other possessions.

The current insurance industry profoundly depends on brokers, who convince the customers to buy varied insurance policies. This industry is, however, facing agitation because the traditional insurance process involves paper contracts that are prone to errors during drafting or claiming insurance.

Other than that, the insurance industry is facing big-time troubles to imbibe trust in their customers. People want reliability for the amount of premium they are putting into their insurances.

Welcome Blockchain! The answer to all the insurance problems faced by customers as well as insurance companies.

Blockchain is a distributed ledger with no central authority and everyone participating in the system can access information anytime and anywhere. Also known as Distributed Ledger technology, blockchain consists of blocks of data that are linked with each other, are immutable, and encrypted.

The adoption of blockchain for insurance companies has grown remarkably well in the last few years.

Introducing blockchain for insurance industry can reduce costs, cut several intermediaries, automate claiming, track records, deliver easily, and prevent fraud.

Let us see awesome Blockchain use cases when it comes to the insurance industry and how it would affect the insurance processes.

Blockchain: The technology that is transforming the economies around the globe

This document highlights how countries around the world are using this incredible technology for transforming the governance, businesses, and lives of their citizen…

The answer to all the insurance problems faced by customers as well as insurance companies

DeFi Insurance with Blockchain for Insurance Industry

Streamlined

__________

Blockchain for Insurance enables the execution process easily, smoothly, and speedily. Known as the foundation of Web 3.0, blockchain use cases delivery enables transparency in financial transactions. It simplifies underwriting, claims, reinsurance, and payment processes. Conditional events are triggered via smart contracts which are self-executing lines of code and because of such automation, several levels of third-party intermediaries.

Higher Security

__________

The decentralization offered by blockchain provides high security in the insurance industry. Unlike the traditional and costly servers that insurance companies rely on, the blockchain network doesn’t get hacked or broken. Also, the insurance policyholders feel secure about their personal information staying safe in the hands of encrypted blocks on the blockchain.

Blockchain for insurance also protects from identity verification and helps in the notarization of documents owing to it being a peer-to-peer network.

Reduced Costs

__________

Smart contracts eliminate the intermediaries and the distributed nature of blockchain avails added security and transparency. This helps insurance companies big time to reduce their costs. Almost 15-25% fraud is projected to be eliminated with such smart blockchain use cases , which leads to conserving $10 billion across the insurance industry and will benefit the customer. Also, customers will have to pay lower insurance premiums as things go fast, trustworthy, and error-free.

Better data storage

__________

The data saved on the blockchain distributed ledger is immutable, and hence it is the single point-of-truth upon which everyone relies. These data stores are reliable and are accessible in a secure manner. They are opening doors to real-time data for further cost-cuttings.

This enables Blockchain to meet the ever-changing needs of insurance policyholders.

Scope of Blockchain Use Cases for difference Insurance Verticals

In this highly insured world that we are living in, people are getting varied types of insurance ranging from pet insurance to vehicle insurance, accidental death insurance, and life insurance.

Let us take you around which segregated sections benefitted when Blockchain for insurance companies gets implemented.

Health Insurance

__________

The most essential of all is health insurance. Many countries like America have mandated healthcare insurance and people are not supposed to live there without a legal health insurance policy for their life because most of them go bankrupt because of their medical costs.

Blockchain for insurance companies enables healthcare operators to function efficiently and provide reliable health insurance. Innovative blockchain use cases in the field of insurance can help get the patients covered by insurance through effective data analysis.

Car Insurance

__________

Blockchain can disrupt the auto insurance industry by offering drivers better quotes and resolving their claims faster. The decentralized public ledger stores all the previous damages on the vehicle and hence the process is simple and easy for underwriting and all the paperwork is eliminated.

Life Insurance

__________

The blockchain distributed ledger technology can combine the death registration processes by the insurance companies, funeral homes, government, and beneficiaries to avoid the confusion. It saves time and money by automating the processes and executing event-based smart contracts.

Travel Insurance

__________

With the use of decentralized systems, the insurance companies can work hassle-free as they get real-time updates from the synchronized airline industry. It also benefits travelers to even avail micro-insurance from short-international trips.

How can you build your own blockchain applications

If you are a developer or from the tech industry, then you might be more interested in Blockchain implementation more than Blockchain Use cases. Well, then this section is specifically for geeks like us…

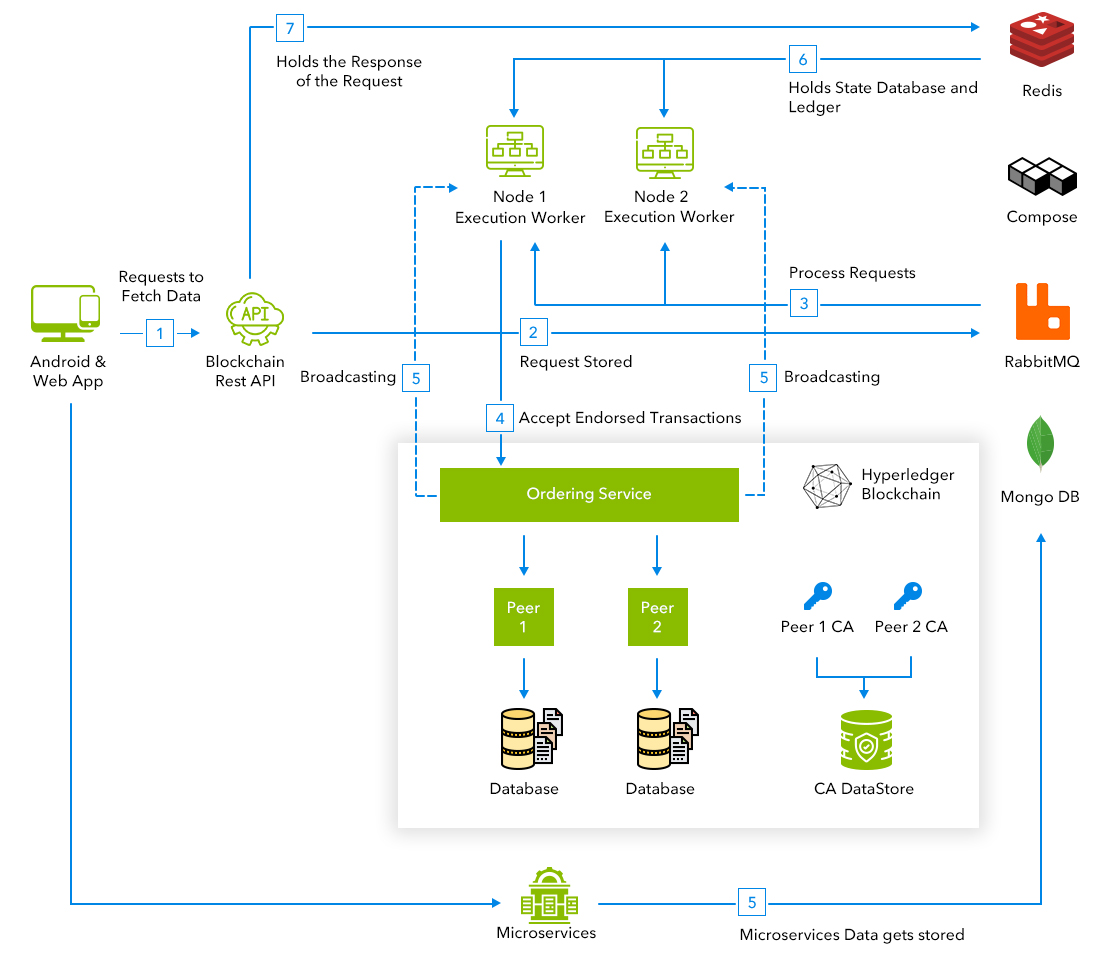

1. Install Essentials

__________

- Primarily, you can create a Kubernetes cluster with Google Cloud Kubernetes Engine to deploy the containerized app in the cloud. Kubernetes engine eliminates the need to manage, install and operate your own clusters.

- Next, you can install an open-source and cross-platform JavaScript Runtime environment- Node.js that allows the scripted code to run on multiple platforms.

- After that, you can install Docker Engine and Docker Compose.

- Finally, you can install Hyperledger Fabric Node SDK to support Node.js. This can enable APIs to interact with the Hyperledger Fabric Blockchain.

2. Defining Technical Components

__________

Technologies that can be used in the development of difference blockchain use cases for insurance services

Hyperledger Fabric v1.0

This is a blockchain framework implementation which is considered as the foundation to develop any blockchain use cases for insurance companies

Android SDK

Android SDK (Software Development Kit) is a comprehensive set of development tools to build applications for Android devices. It offers complete API libraries and developer tools to code, test, and debug Android apps.

iOS SDK

A software development kit for developing native apps Apple’s iOS platforms and devices.

React Native

React Native is a framework for building native mobile apps with scripting languages- React and JavaScript.

MongoDB

MongoDB is a go-to-JSON data store for both enterprises and startups. Significant querying, aggregation, wide driver and indexing support are its extraordinary features.

Redis

Redis is an open-source, in-memory data structure store which can also be used as a message broker, database and cache. It is a good platform to use a message queue.

Rabbit MQ

RabbitMQ can be deployed easily in the cloud and on-premises because it is light-weight. It can support multiple messaging protocols and enable you to keep a separation between app layers and data.

Once all the components and software are installed, you can configure a blockchain network that acts as a backend for your mobile app.

3. Configuring the blockchain network

__________

- Before you configure the blockchain network, you can get a Compose for Redis and RabbitMQ credentials from the main page of each service in the

Google Cloud Dashboard. - In the cofig.js file saved in the blockchain container folder, you can modify the values for redis and rabbitmq with your credentials.

- Once the values are modified, the next step is to configure all yaml files to use the instance of MongoDB. You can get the URL and certificate for the

MongoDB dashboard in Compose.

4. Deploying the Blockchain Network in Kubernetes

__________

- You can deploy all the microservices for the application in Kubernetes.

- You can test the blockchain network with its API client and use the external IP of service to perform a curl request.

- Once the curl request is executed, check the result with the resultID. Success status implies that the blockchain network can now be integrated with the app.

- To integrate your mobile app with blockchain, you need to deploy some more microservices needed for the mobile app.

5. Exposing the backend with Kubernetes Ingress

__________

- Once you have deployed the blockchain network, you can expose the back-end so that the application can communicate with the network.

- You get the functionality to expose the microservices with Kubernetes Ingress.

6. Configuring and testing the app

__________

- You can configure the application to perform REST calls to the backend of Kubernetes.

- After configuring the app, it is time to test (Alpha & Beta testing) either on an emulator or a real device.

The Best Blockchain Use Cases for Insurance Companies

If an insurance company or startup can leverage the following use cases then it is almost guaranteed that they will fortify the relationship with their customers and their market share.

Claims Handling

__________

Insurance companies have loads of tasks to undertake and the majority of them comprise filing claims, validating claims and approving claims. Blockchain for insurance company offers a trustless identity verification and smart contracts enable the execution of actions automatically. This improves faster claiming processes.

Being the intermediary, smart contracts can behold funds that are neither yet assigned to the policyholder nor are allocated to the insurance company. When an event triggers the smart contract, funds are transferred to the correct party.

Traditionally, approving a claim consumed a week or a month even as it incorporates various web portal updates, paper documentation, and photocopying. However, smart contracts enable claim approval instantly.

Reinsurance

__________

Reinsurance is the insurance taken from other insurers to avoid risk during disasters. Blockchain for insurance companies can be a helping hand as it can automate calculations and work out rebalancing funds by tracking financial risks and improving the overall reinsurance policy.

Customization

__________

Customers get transparency on the blockchain, making them reliably save their data and providing access to others. They like it when they get customized insurance policies and the public distributed ledger enables insurance companies to avail such offers to their customers.

Blockchain uses public-private key technology that doesn’t link customers’ data with their profile identity that makes the data sharable and easily transfer of profiles for automated policy customization.

Real-time claims and payment automation

__________

The Smart-contract technology within Blockchain for insurance enables customers to get their claim requests approved instantly as there is no need for paperwork or identity check. Such smart contracts are linked with crucial events on the occurrence of which the insurance claim is automatically processed. Parametric insurance is one such form of insurance that is event-based and requires less human workload. Thanks to blockchain, such types of insurance can now become an industry norm and there will be no need for claim verification by humans.

This provides better customer experience for the customers and prevents losses incurred on insurance companies.

Underwriting

__________

Underwriting is a crucial process that requires expert data analysis before calculating a customer’s coverage for defining his insurance cover. Blockchain’s data storage management and analysis tools have enabled underwriters’ tasks to execute efficiently, speedily, and risk-free. It also adds a level of transparency in the underwriting process that strengthens the trust between customers and insurance companies.

Big Data

__________

The most significant use case of blockchain is the storage, handling, and management of large amounts of data that the insurance companies are able to store efficiently on the blockchains. It also enhances the way this data is shared, accessed, and streamlined amongst multiple parties. By using fingerprinting and timestamping, blockchain for insurance companies can create a secure and shared repository for insurance policyholders. This enables insurance companies to work with affordable and calculated risks to facilitate great customer-experience and deliver trust seamlessly.

The Power Lies In Your Hands.

If you like this blog, then please do share it.

Share This Article On

Conclusions

To match up the march past of all other industries, the Insurance industry has to bring upon a makeover to overcome its outfalls and the good news is the evolving Blockchain for insurance is all set to prove its magic on the Insurance World.

Ranging from underwriting, including claim handling, and auto payments, Blockchain use cases for all the areas of insurance operation the power of Smart Contracts and distributed public-private key ledger that not only benefits the Insurance companies but their customers as well.