G.O.A.T Healthcare Investments Between 2015 to 2020

The healthcare industry has never been under the influence of recession. In fact, the recession has benefitted the healthcare industry. And why only recession? Natural disasters, calamities, and the latest in the cohort, pandemic–every negative factor has positively influenced the healthcare sector. However, to bring it to the level that ‘HealthTech’ is today, technologists, medical practitioners, and investors making healthcare investments have shouldered several responsibilities.

One of the crucial aspects of exponential growth is the trust that investors making healthcare investments have put into the sector through their working capital. The technologists have made efficient use of the healthcare investments with the incorporation of the latest technologies, and the medical practitioners have utilized the solutions exceptionally for the welfare of patients.

Getting inspiration from this team, numerous healthcare professionals realise the new horizons that they can tap using the technology. On the other hand, investors are turning moths to the profitable shine of the returns of healthcare technology. So, getting an investment for a new healthcare technology business isn’t as difficult as it was a decade ago.

Don’t believe me? You will, when I show you the tons of money put in by investors in the healthcare technology businesses from 2015 to 2020.

Health Catalyst Pumped USD 70 Mn to be Valued at over USD 500 Mn

Incepted in 2008, Health Catalyst is one of the fastest-growing data analytics companies in the healthcare technology sector with its data analytics capabilities. It is home to over 1,900 clinics and hospitals, which roll out revenue of over USD 135 Bn.

The Health Catalyst CEO, Dan Burton, took this executive decision to bring advancement to the clinical workflow for improving the clinical as well as financial outcomes in the healthcare systems, which attracted the Series D round of funding by Norwest Venture Partners, Sequoia Capital, Kaiser Permanente Ventures, Sorenson Capital, CHV Capital, and Partners Healthcare. In addition to the big shot investors, new investors–Sands Capital Management, Tenaya Capital, Epic Ventures, and Leavitt Equity Partners also extended their financial arms to underpin Health Catalyst to count USD 70 Mn in 2015.

ZocDoc Levelled Up from Doctor Appointment Booking System with USD 130 Mn

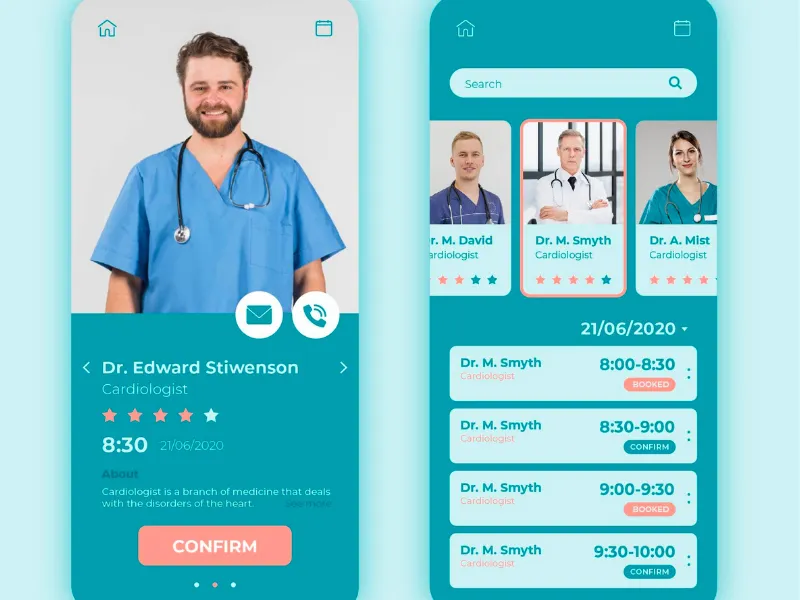

ZocDoc came to life in April 2007 and is running the online healthcare services through Android and iOS apps facilitating users with telemedicine. ZocDoc realized that the doctor appointment booking system is no longer a unique selling point for healthcare technology businesses. Hence, the investments can be pushed to, in turn, push the limits of telemedicine operations towards solving patient problems and channelizing broader patient interaction within the digital space.

The existing investor of ZocDoc–Founders Fund assisted Atomico and Baillie Gifford to invest USD 130 Mn in ZocDoc in 2015. Post this, ZocDoc also made the most out of the pandemic by launching a pilot program to schedule COVID-19 vaccine administration appointments along with Mount Sinai Hospital.

Ping An Good Doctor Raised the Largest Healthcare Investments of All Times

Guess how much?

Five. Hundred. Million. Dollars.

Ping An Good Doctor, unlike its competitors, is a relatively young healthcare technology business with its founding in June 2014. It primarily provides a mobile channel for hospital referrals, health management, online consultations, and wellness interaction services. Its underlying aim is to improve the efficiency of doctors to offer better care to patients.

Following its objective, it raised a Series A funding of USD 500 Mn in 2016, led by the Chinese state-owned enterprises and International private equity funds. The recent valuation of Ping An Good Doctor has broken all the records existing in the healthcare technology sector, as it has been recognized as a Unicorn business with healthcare investments.

Teladoc Health’s Debt Financing Cushioned by Silicon Valley Bank

Founded in 2002, Teladoc is the world’s first and only healthcare technology business leader offering holistic virtual care, addressing a full spectrum of well-being through advanced technology, human expertise, and analytics. The Teladoc’s network is quite huge, with over 6,000 clients, 3,000+ board-certified physicians, and over 15 Mn members.

In 2016, Teladoc secured funding of USD 50 Mn from Silicon Valley Bank for debt financing and general corporate purposes. The business relation of Teladoc and SVB dates way back to cushioning the financial blows of the healthcare technology giant with flexible transactions to maintain business efficiency.

Google’s Sister Verily Bagged a HUGE Funding as Operational Capital

Guess how much?

Okay, we have a competitor to Ping An Good Doctor’s five hundred million dollars–Verily. Alphabet’s Verily was found in December 2015 as a research organization to study the life sciences. The mission that drives Verily is to turn the healthcare data useful for patients to enjoy a healthy and lengthy life.

Given its ambitious mission, it received one of the largest healthcare investments worth USD 800 Mn from a Singapore-based investor, Temasek, in 2017. Temasek, in return, claimed a minority stake in Verily and a nomination in the board.

Practo Raised USD 55 Mn to Power Up its Integrated Platform

Established in 2008, the Indian-based healthcare technology business–Practo–provides telemedicine solutions for health and medical needs. India’s leading online health consultation app connects millions of patients and thousands of medical practitioners across the world through consultations and appointment booking ease. Currently, it has about 200,000 practitioners, 5,000 diagnostics centers, and 10,000 hospitals on its platform.

In its march to simplify the healthcare operations, Practo received healthcare investments of USD 55 Mn in its Series D round in 2017 from Tencent. Thrive Capital, Ru-Net, RSI Fund, Sequoia, Matrix, Capital G, Altimeter Capital, and Sofina.

Livongo Moved Beyond Diabetes and the U.S. with USD 52.2 Mn

The rise of Livongo can be dated back to the fall of 2014. Within a span of less than a decade, it has become a prominent name in the healthcare technology space with its intense focus on helping patients cure diabetes. The company offers health monitoring devices, lancets, unlimited strips, health coaches, and personalized insights to patients upon joining the portal to better cure chronic disorders.

General Catalyst, Kinnevik, Microsoft Ventures, American Investment Holdings, and EDBI saw the potential in Livongo. It funded a total of USD 52.5 Mn in 2017 to accelerate the growth beyond the diabetes segment towards adding the other chronic conditions and offer a comprehensive solution to patients.

Oscar Health Caused Another Disruption with its New Funding

Since its founding in 2012, Oscar Health has been causing severe disruption to the traditional healthcare industry with its new reforms, including the tech-fest. The company is seeking opportunities in the marketplaces for users to purchase health insurance. Oscar Health strives to beat the large insurance providers such as Aetna and UnitedHealth through its focus on technology and customer service.

Given its recent shift in the business model, investors have shown interest in the company. As a result, Oscar Health has raised healthcare investments worth USD 165 Mn from Founders Fund in 2018.

Grail Got to Boost its Total Investment to USD 1.5 Bn

The biotech giant, backed by Jeff Bezos and Bill Gates, was launched in 2015 as an American biotechnology and pharmaceutical company. It went out to aim for the challenging aspect in the medical domain–seek out the detection of cancer at early stages among people having no symptoms of the disorder.

In 2018, Grail was able to push its total healthcare investments to USD 1.5 Bn by raising USD 300 Mn in a Series C round of funding. The funding was initiated by Ally Bridge Group, Blue Pool Capital, China Merchant Securities International, CRF Investment, HuangPu River Capital, ICBC International, Sequoia Capital China and WuXi NextCODE.

Dispatch Health Patched its Way Up to Raise USD 33 Mn

Mark Prather, the CEO of DispatchHealth, brought the company to light in 2013 to build the advanced and comprehensive in-home care healthcare model in the world. The company uses the Uber business model to offer on-demand healthcare services to users of all ages at the comfort of their home.

Besides this, the company aims to reduce unnecessary stress among medical professionals and patients by decreasing emergency room visits and hospitalization rates. This, in turn, narrows down to decreasing the healthcare system’s extravagant cost and improving clinical outcomes.

In 2019, DispatchHealth raised UD 33 Mn in its Series B funding, led by Questa Capital & Alta Partners and Echo Health Ventures to boost the number of house calls.

Babylon Health Raised its Valuation to USD 2 Bn+ through Healthcare Investments

The U.K.-based healthcare technology startup, Babylon Health, was founded by Ali Parsa in the year 2013. The health service provider offers remote consultations through video messaging and text messaging through mobile applications. Babylon Health operates on the subscription model to bring accessibility along with affordability for patients.

Following its aim, Babylon Health secured funding of USD 550 Mn in 2019 for the incorporation of Artificial Intelligence in Healthcare. The investment was led by Kinnevik, Vostok New Ventures, Munich Re’s ERGO Fund, Centene Corporation, and PIF.

Tencent Trusted Doctor Received Trust of its Investor Along with USD 250 Mn

Tencent Trusted Doctor was found from the merger between the Trusted Doctor and Tencent Doctorwork. It is one of the technology-driven companies intending to streamline the public healthcare system of China. The company offers online consulting services, doctor service platforms, offline hardware and clinics, and institutional message management for patients.

The company connects over 440,000 certified doctors and over 10 Mn+ patients. Given its robust acceleration pace, Country Garden Holdings invested USD 250 Mn in a fundraising round for focusing on public disease awareness and better accessibility to healthcare services using the digital platforms in China.

Olive Meets the Profitable Pie with USD 225.5 Mn

Established in 2012, Olive has been a pioneer in artificial intelligence as well as RPA solutions for improving efficiency and patient care by reducing administrative errors. It is sold as a service at an annual price to work on the complex decision-making process with the utmost accuracy.

In order to cement its position in the healthcare technology market, Olive announced that it had received funding of USD 225.5 Mn from Tiger Global, General Catalyst, Drive Capital, Silicon Valley Bank, GV, Sequoia Capital Global Equities, Dragoneer Investment Group, and Transformation Capital Partners in 2020.

DXY Raised USD 500 Mn to be More Patient-centric

DXY is known as an online community for medical practitioners in China. The 20-year-old company, found by Li Tiantian, started its operations as an online platform for connecting medical professionals to discuss the best practices and novel developments.

Trustbridge Partners with GL Ventures and Tencent recognized its efforts and offered an investment of USD 500 Mn to build the platform for addressing physician and customer-centric solution in 2020.

Alto: The Pharmacy Startup Gained Momentum from SoftBank

Established in 2015, Alto, the new-age pharmacy startup in the healthcare technology business sector, was found by former Facebook employees. The company competes with Pillback and Capsule Pharmacy. It caters to the users’ requests for medicine delivery on a same-day basis.

In 2020, Alto secured the funding of USD 250 Mn from SoftBank, enabling the valuation of USD 700 Mn to the company. The company is currently working with doctors to list out the most affordable drugs for users.