Do you understand the pain of the users who have used those outcast mobile banking apps? Anchor this page if you want to be aware of the banking app disasters and how you can salvage from the pain.

Though mobile banking initially sprouted in the form of SMS banking service, banks now allow its customers to avail unconditional banking on their smartphones not far from a mobile bank in their pockets.

However, commendable banks are making giant bloopers when it comes to mobile banking app development. It is rightly said that you shouldn’t wait to learn from your mistakes. It’s ideal if you can learn from other’s mistakes!

Let’s see what consumers have to say for some existing bank apps

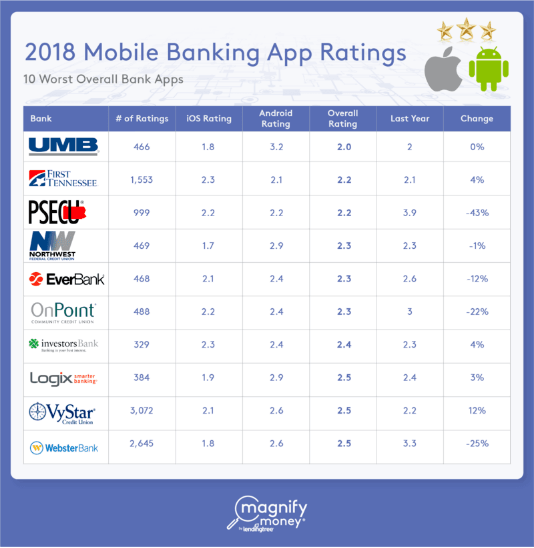

MagnifyMoney is a leading site that helps consumers understand personal finances by guiding tools, comparing finances, and sharing perspectives on monetary affairs. In 2018 end, MagnifyMoney brought out research on mobile banking apps and has provided ratings for different leading and discomfiting banking apps. We will use those statistics from MagnifyMoney to draw our insights on the flaws of the banking apps so that we learn better mobile banking app development.

Here’s the list of 10 Worst of all Mobile Banking Apps provided by the following banks/ financial credit unions in 2018 according to MagnifyMoney:

- UMB Bank

- First Tennessee

- Psecu

- Northwest Federal Credit Union

- EverBank

- OnPoint

- Investor Bank

- Logix Smarter Banking

- VyStar Credit Union

- Webster Bank

Also, please note that:

The listing by MagnifyMoney was published in December 2018 and thereafter in a few months as we study the mistakes of those banking apps, we have gathered the ratings and reviews of them as per the date of writing this blog.

The apps provided by EverBank, OnPoint, Logix Smarter Banking, and Webster Bank have significantly improved their reviews and ratings on both the Android and iOS platforms in a short span of time, so we haven’t included them in our report.

The impetus behind writing this review report of Banking Apps is to portray what is upsetting the users of these apps, and what things should be kept in mind to develop a high-class banking experience app. First, let us go through the reviews of the above-listed banking apps and in the end, we have gathered the summarization for you that can be considered as the Dos and the Don’ts for mobile banking app development.

Let’s see what went wrong with these banking apps, so that we can avoid such mistakes and become the best banking solution. The best way to judge an app is through real-time user interaction and feedback. So here we analyze user reviews of these worst apps to learn from their misstep.

This mobile application stands for the UMB Financial Corporation, which is over 100 years old financial services holding company founded in Missouri, America. It provides complete banking solutions for its customers.

Android User Reviews:

“I’m really irritated that the app keeps logging me out…”

“Constant 101 error. Unable to view transactions….”

“The interface is horribly outdated, does not allow transfers to an account…”

Android User Ratings: 3.3 / 5 stars by PlayStore

Adding to these, Apple device users also do not have a pleasant experience with the app.

Apple User Reviews:

“…..The IT team has no clue what a functional “User Experience” ought to be, leave alone the feature of standard service that comes with any banking app – Cheque deposit………….”

“…….it doesn’t work with Face ID on my iPhone…. – I have to re-sign-in and answer security questions every single time. An attempt at mobile deposit took about 10 minutes to get pictures that it would accept……..”

“…It often has glitches, needs the numeric keyboard to pop-up…………. The app can’t decide whether I need to fully log in, use my thumbprint, or allow recognition of my device……”

Apple User Ratings: 1.4 / 5 stars by AppStore

Noting that UMB’s mobile banking app for Android has improved its PlayStore rating by 0.1 stars from previous 3.2 stars but however, it has consistently dissatisfied apple users going down from 1.8 to 1.4 stars. All such reviews depict that this app lacks the Security traits that are inevitable for a banking app. Moreover, users are really annoyed by a bug that logs them out frequently. Most of the reviews convey that the app lacks in user-experience too.

A mobile banking app development company cannot miss the major feature that the bank’s user relies on the mobile app for- showing transaction history.

Per Contra, to keep up its reputation, the bank app developers must forthrightly fix the bug that is bothering bank’s customers, and provide a better UX design and reciprocate. Login is the first interaction of the user with the app, having crunch here would not keep your customers glued to the application.

PSECU

The largest credit union in Pennsylvania, the Pennsylvania State Employees Credit Union offers this mobile app for its mobile users. Psecu serves over 400,000 members and has over $5 billion in assets.

Android User Reviews:

“Running slower than usual. You can’t use the back button to close the app. Pin number buttons take more effort to press and this is happening on more than one phone.”

“…..This app has actually gotten worse since the rollout. Half the time it doesn’t even launch. The thumbprint often doesn’t work. The transaction screens are blocked by the phone’s keypad. It loads and spins forever……..”

“This app is inferior to its predecessor in every way. A real shame since PSECU is typically the first rate with its product and services. Mobile banking is an absolutely crucial feature. Please get this fixed.”

“Loved old app, hate this one. When trying to make a deposit the picture, no matter how clear, will get a rejection box from the app. Also if you use fingerprint to open app and the app isn’t “ready” bc it takes a while to open, then it gets stuck on stupid and you have to close it out completely and restart. I love my credit union, I hate my credit unions app.”

Android User Ratings: 2.9 / 5 stars by PlayStore

Apple User Reviews:

“……told that my device isn’t secure enough to use it?! I’ve been using my iPhone 5S for many years …………..I’ve never had a problem with literally ANY other banking app or any other apps that handle sensitive data.……I have half a dozen other banking apps that work with no problems on my phone. What exactly about the iPhone 5s makes it not secure enough to run your banking app?…..”

“SO. SLOW.

………….This app is SO SLOW………. Depositing checks is also a pain! Not only is it slow to load the photos I take, it takes FOREVER to accept the deposit. The app also crashes several times before accepting a deposit—so it takes me up to 15 minutes to deposit even one check!….”

Apple User Ratings: 2.5 / 5 stars by AppStore

As recorded in December 2018, current ratings show that they have been struggling hard to earn better ratings. They have improved a bit but still, have a lot of mess to be cleared ahead.

According to the users, the update isn’t working well for the app. The banking app is pitiably slow and such a feature is next to having no feature because no one has the time to wait for eternity. People are sure to expect a lot better than this from such a renowned credit union.

The PSECU credit union must surely invest in a curative mobile banking app development company so that its app rating and review can be saved from drowning.

Northwest Federal Credit Union

This one’s a trusted and well-established credit union of northern America. It has been serving people for 70 years now. Let us see how do users find its mobile app service.

Android User Reviews:

“You’ve now made the app crash on startup, and if I get it to log in it won’t display any info but a blank screen!”

“Summary is just a blank screen. You get more information bypassing the app and going directly to the NW site.”

“This new update makes the app useless. It won’t show account summary, all you get is a white empty screen. Good job guys, you made a garbage app even worse.”

“………..The account summary page is blank so you can’t see your balances and can’t click on an account to view transactions. When I tried to transfer money it took forever for the screen to load. There have been no improvements………”

Android User Ratings: 2.9 / 5 stars by PlayStore

Apple User Reviews:

“It’s a downgrade, not an upgrade!!

The online system including the mobile usage on the website was doing fine, wasn’t the best but this new upgrade is the worst interface with almost non-existent update………….I couldn’t resist this unacceptable standard of app ….. Please, do not bring the standard of this otherwise an excellent business operation that low.”

“Words cannot describe my pain…

……….speak on general usability—that is, in fact, the sole purpose of any application, anywhere. It doesn’t work. The buttons are semi-responsive; the menu doesn’t pull up 80% of the time…………..”

Apple User Ratings: 4.1 / 5 stars by AppStore

These are few months old comments from the App Store but the current ratings evince that they have managed to reach out of threat by collecting good reviews and have been rated as a good app now. They have risen from 1.7 to 4.1 stars on the apple store which is an excellent leap.

However, there are no improvements in the Android user ratings and reviews clearly depict that the latest update of the app is bad. Accounts are not accessible and users are disappointed as they see blank screens on app load. It seems this mobile banking app development lacks security.

It should be bookmarked that to hold a good name, one has to recover and maintain overall development. But, it’s not too late to take up from where you had hauled in the past. And the future will be in your favor.

Investors Bank

The Investors Bank has been serving in New Jersey and New York for 90 years. It has publicly traded on NASDAQ under the symbol ISBC. Let us what services does it provide for its mobile device users, who prefer to bank through their smartphones.

This Bank has subsequently improved its mobile banking app development tactics and hence turned its ratings and reviews to a better position than when it was mentioned in this list by MagnifyMoney.

Android User Reviews:

“deposit function vastly improved, worked great! other great functions (no-login balance check, transfer between accounts) still intact.”

“This ap is great despite the occasional login issues.”

“Great and much needed upgrade!”

“I love the app, but recently it crashes every time I open it. Please get it together.”

Android User Ratings: 3.1 / 5 stars by PlayStore

Apple User Reviews:

“Every time I try to gain access to my online banking which is normally on a biweekly basis I’m directed to call in office at which time I learn I’m locked out and have to change my password. This has been a great inconvenience and because the problem has not been fixed I’m currently looking for another bank to secure my funds.”

“Terrible App

I have been very happy with your App, then I was alerted that I had to update the app. Do not ask me who decided to delete the calendar and the calculator, most helpful features that were there! Hire another company to develop your Apps. Terrible!”

Apple User Ratings: 4.7 / 5 stars by AppStore

This bank is in the race to win and is showing no signs of being knackered. It had gone up from 2.4 to 3.1 stars on android platform and from 2.3 to 4.7 which is extraordinary upsurge on the iOS app store.

User comments reveal that an update of this app deleted all the past data and records from the device. When users try to log in, they are automatically locked out. That is surely irritating. Moreover, it crashes the time you try to open it again. Apart from this, the app has managed to suffice and overcome its flaws to reach the current ratings.

Investors Bank can be taken as an example to learn from for all other wavering banks. They must have used secure and reliable mobile banking app development which has aided them fruitful results.

VyStar Credit Union

VyStar is a credit union founded in 1952 and is chartered by the Florida Office of the Financial Regulation. It is federally insured by the National Credit Union Share Insurance (NCUSI) and offered by the National Credit Union Administration(NCUA). It offers deposit and loan services for consumers and businesses, as well as non-deposit products and services such as investments, retirement planning and financial counseling.

Android User Reviews:

“….I just reinstalled it, but it’s still running slow. It just says “securing login” but never goes any further. If I’m out and about, I have to access my account on the web, not very helpful…..”

“unreliable. recently switched back to Android from IOS. this app needs to be redone before people switch banks purely for convenience of having quick reliable mobile access to their finances. please fix, and no I don’t need help troubleshooting. as its a software issue on your end and not a hardware nor an issue on my end.”

“I recently switched from iPhone to Android and the difference between the two versions is night and day. you can tell they give the iPhone version a lot more love. Almost every time I try to login to my bank account the app stalls and never does anything….”

“as others have stated, there has been a bug for months that won’t allow you to log in without force closing the app first or uninstalling and reinstalling the app. absolutely unacceptable for this to not be addressed yet. I need to be able to check my account daily. considering changing banks because this has been so frustrating.”

Android User Ratings: 2.6 / 5 stars by PlayStore

Apple User Reviews:

“Great app and great bank

I made the switch to VyStar a few years ago and I’m happy I did. While there were some things that were frustrating at first I feel VyStar is actively looking to improve things and get their app working as best as it can be. The update today improved a few things including visual effects of the app when in full screen. It also added the Zelle functionality and improved mobile check deposit. I am very pleased with this and look forward to future updates!”

“Cannot transfer money from external account

…… the app does not offer the ability to transfer funds to my kids account from my external account, even though the accounts are linked.

In order to transfer money, I have to go to the full site. This is extremely inconvenient; the app should offer the ability to make transfers from external accounts.”

Apple User Ratings: 4.5 / 5 stars on AppStore

The Android phone users have been capsized for poor functioning of the app. There has been nil increment in the android ratings. Customers expect their banks to be Superman, so they should at least be getting the basic eminent features for mobile banking.

The app for Apple devices has shown drastic improvement going from 2.1 to 4.5-star ratings on the app store. I hope it does the same way with the Android App. There are major log-in issues with the Android App.

It takes two to tango! This can be our simplest and modest advice to this bank looking at their mobile banking app development performance.

Read in detail about different niches of Fintech Industry

Summarising major features affecting your banking app users the most

Foresightedness is always better than reparation. Let us focus on how we can improve our mobile banking app development from failing as we now know what can spill the mobile bankers.

From all the reviews that we heard of the unsatisfied users of the mobile bankers, we make that the following traits cannot be neglected:

1. Security

This one surely has to be a synonym for Banking. It is beyond doubt, one of the best banking app features. Banks define security so how can the mobile banking app development not give reliable security options to its users?

Most banking apps fail to meet the security solutions that ought to be the prime arrangement of banking. However, we have here highlighted the key-points that must be taken care of by you as a bank while mobile banking app development:-

- To ensure security, mobile transactions must be integrated with the latest digital signature technologies.

- To avoid theft and third-party intervening on data, an encryption program should be installed on the storage cards.

- There should be no phishing emails or spam messages sent on mobile devices, and hence the application servers must be configured accordingly.

- A password checker can be built to ensure that the user’s PIN and passphrases are kept safe and the user can just log in with intermediate credentials.

- All the security policies that are functional for the web application for banking should be reconfirmed after implementing the mobile applications. This will govern the use of mobile devices on the network.

- Make your users comfortable while navigating your app.

Apart from these, another thing which goes along with the security feature of mobile banking app development is how critically the users use it. You must educate your customers to use mobile banking services cautiously by every time logging out of the app, not sharing passwords/OTPs with anyone etc. The app development company cannot do much if the customer uses the bank app reluctantly.

2. Simple design, minimum functionality, and Brisk results

Users get bothered by the complex and unpredictable design of the banking app.

Banking apps should clearly and straightforwardly aim at what it is made for- Banking! There’s no need to append more and more functionality just to increase the load time of the app.

Most banking apps miss out the essential tools like the search and the history option which are the basics that user might want to check while accessing his/her bank account.

The most annoying thing while using banking apps is the time it takes to load. It is not necessary to deploy the entire web/ internet-banking facilities on the mobile platform. If an app would be lengthy, it will take more time to load than normal.

So, it’s useful to keep the app with the minimal and necessary functions that the user indeed needs.

3. Personified User Experience

Your customers will love your mobile application if they get a great experience while using it.

By keeping in mind the following instincts will help you create better mobile banking app development:-

- The key operations should be available with ease and intuitive navigation.

- Avail your users the privilege to customize their notifications and the content they want to receive.

- Avoid overfilling the app with information and give your mobile App link on the official bank website.

- Undergo rigorous testing before deploying the app as your customers won’t appreciate infirm mobile banking.

- Each user’s experience can be customized depending on his/her frequently used operations over the banking app.

These are the mandatory drawbacks that must be tackled to attain and retain your customer’s trust as a Reliable Financial Company/Bank. However, change is a continuous process. Along with keeping pace with the mandatory functionalities, also check out the future possibilities in the mobile banking app development sector.

To lead the crowd, you must stand out and adapt to change earlier.

Sneak-peak in future of mobile banking app

Technology is spreading in the avalanche pattern. Watch out for these future surprises in mobile banking app development:

Being in the vital business domain, banks and financial credit unions need to keep with the formidable technological changes.

People indubitably need Banking, but they certainly don’t need Banks anymore. Smartphones are going to be the cognate remote banks that move along with the user in their pockets all the time.

Step forward to build such a banking app for your customers that will give them a magnificent experience. We, at TRooTech do provide mobile banking app development solutions so what are you waiting for?

Follow Us On