Recovered from the after-shocks of the financial crisis of the last decade, the financial markets have moved ahead with a stride thriving to bounce back.

Accompanied by technological evolution, regulations, and modulating customer behaviors, FinTech has risen to new heights.

FinTech is short for Financial Technology. It includes a large number of products, technologies, business models, and financial services. It refers to everything between cashless payments, to crowdfunding platforms, to Robo-advisors, to virtual currencies.

Global Investments in the FinTech industry have added up to $111 billion last year according to Klynveld Peat Marwick Goerdeler KPMG report. The only reason for this amount of investment is that consumers are adopting FinTech trends faster than anything else. One out of every three people across 20 major economies reports using at least 2 FinTech services in the last year. More than half of the consumers in China and India are using services like money transfers, financial planning, insurance, and borrowing, which makes them leading contributors in FinTech Market.

This exclusive Financial Technology has filled a void for people around the world who don’t have access to traditional banking services. In fact, it is estimated that around 2 billion people across the world are without bank accounts.

Because of such a market scenario in the last few years, numerous Fintech startups have emerged to satiate customer’s financial needs.

In this blog, we are going to see the most important FinTech trends of 2020 which will have predominant impact on business world.

These are the most innovative by-products- FinTech Apps resulted from the evolutions and the technological backbone behind those achievements.

- Venmo – P2P Payments

- Wells Fargo – Biometrics

- SunLife – Artificial Intelligence

- HSBC – Open Banking APIs

- PayPal – Near Field Communication

P2P Payment

Venmo

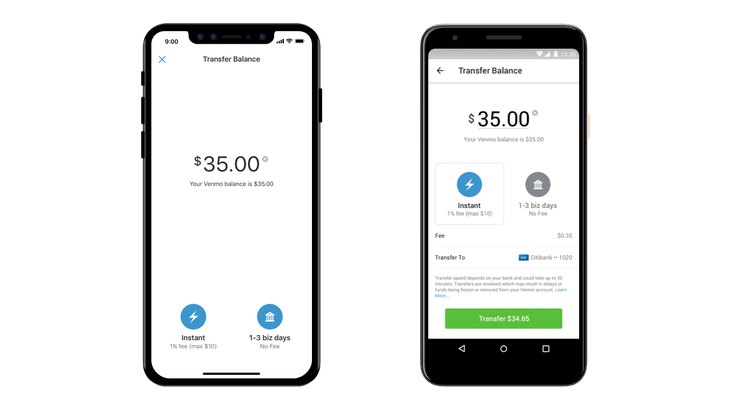

Venmo is a money transfer mobile app under PayPal. Users can transact with their Venmo account balance or can link their bank accounts, credit cards, or debit cards.

Venmo was founded by two freshman-year students at the University of Pennsylvania in the year 2009. The idea prototype was first acquired by Braintree in 2010, and PayPal acquired Braintree in 2012.

How does P2P payment works?

Mostly all the P2P payments work similarly, may it be GPay, Zella, ApplePay, or CashApp, all work in a similar manner. The benefit for the users is that they can transact money without any intermediary.

Users need to link their credit cards, debit cards, or bank accounts to their Venmo account and then they can exchange money. Temporarily the Venmo account balance is deducted or added until the user transfers his/her Venmo balance to the bank account.

Thus, a Venmo account can be thought of as a ledger to represent balance and transactions without executing them outside the platform.

Initially, there is a limit on how much amount users can transmit on first joining Venmo- send $299.9p and receive $999.99 per week. Once the user is verified, transaction limits are increased to $4999.99 and $19999.99 respectively to send and receive.

What makes P2P Payments one of the most important FinTech Trends in 2020?

- Users do not need to carry Debit Cards or Cash.

- Users can easily track their expenses from the app.

- With the P2P Apps, making payment in cross- currencies becomes the problem of the past.

Startups should be cautious about the following points

- The legal laws and regulations of a country like following particular technology standards, a limit on transfer, limits on charges and fees, licensing and more.

- Not keeping the service fees and transaction fees high.

Biometrics

Wells Fargo

Wells Fargo is one of the top four big banks of the United States of America with more than 70 million customers across the globe and spread across 35 countries.

Wells Fargo is one of the pioneers in using the biometrics in the mobile app. But with advanced mobile hardware Biometrics holds an important place in the list of FinTech trends in 2020. The Wells Fargo app is using biometrics to authenticate its users’ identity. The company’s Virtual Channel’s head, Jim Smith asserts that developing biometrics is a part of their emphasis on enhanced cybersecurity to safeguard stolen passwords, threats, and other cyber hacks faced by customers.

The app enables fingerprint, iris verification, voice detection, and face recognition for signing in the app and authenticating self-identity.

How does Biometric authentication work in Wells Fargo?

The Wells Fargo app enables its corporate clients to sign up through EyeVerify’s EyePrintID or any other face and voice recognition. The user opens the app and chooses the eye scan option, following the instruction, he/she looks at the phone’s camera and then at the side to expose the blood vessels at the corner of the eye.

Users can sign-in through facial and voice recognition option, wherein they read aloud a series of numbers displayed on the app screen in front of the phone.

Main benefits of using the biometric

- It adds a very strong security layer which makes the app less prone to Hacking or Fraud

- Biometric gives way more convenient and quicker way of logging in to the application compared to old password system.

Business looking to adopt Biometric should be cautious about

- If you are using biometric then you must ensure it is optimized and running the latest technology, otherwise it will have a very negative impact on the user experience.

Detailed Information about the Different Biometric hardware and thier software

Artificial Intelligence

SunLife

Sun Life is a 154-year-old Financial Services, i.e Life Insurance company of Canada with CAD$1 trillion assets being managed in a number of countries.

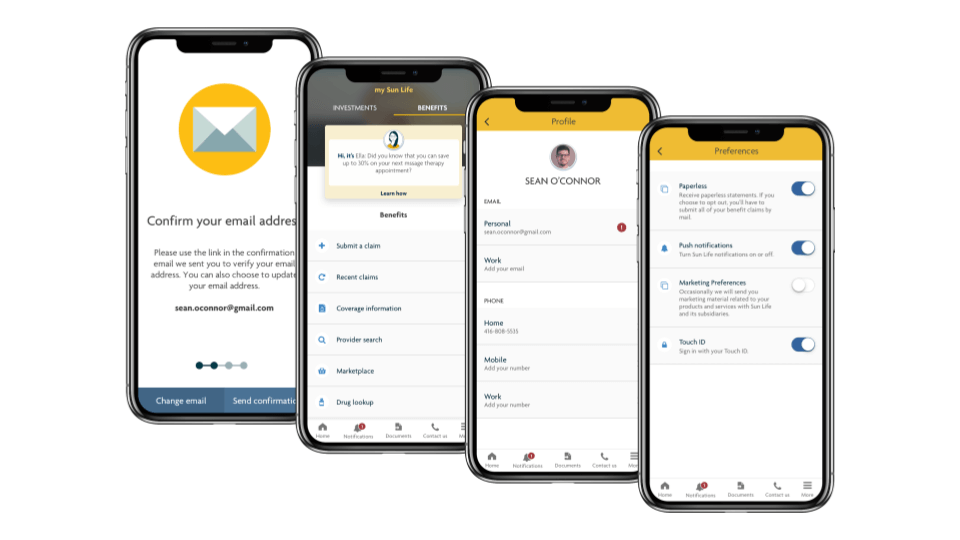

In 2017, Sun Life introduced its first-ever digital coach for their clients that would help them benefit from their pension plans: Ella- an AI assistant.

Ella is transforming how customers can make the most out of their pension plans and to utilize the maximum tools and services their employer is providing. Ella analyses BigData and interactively converses with customers to advise the best suitable insurance plan for them.

In 2018 and 2019 all the companies in financial sector has invested in some kind of AI solutions, and we can safely assume that Artificial Intelligence will be the biggest Fintech Trend in the year 2020

Main benifits of using the AI in your FinTech Business

- AI improves the efficiency of the customer support to hundreds of times. It is what makes AI one of the most exciting FinTech trends of this year.

- AI can help in recognizing the abnormal activities which can prevent hacking and fraud.

- Advance Analytics and Big Data can help grow businesses in unimaginable ways.

The point of cautiousness

- One of the biggest challenges in customer service that the Fintech business might have to face is the lack of human touch with the AI bots.

- And the next thing is if there is no one overlooking at the AI Bots, and if bots can not give the proper solution to users’ query, it will have a very bad impact on the image of the business.

Would you like more examples of Use of AI in Finance Industry?

Open Banking APIs

HSBC

The HongKong and Shanghai Banking Corporation is a multinational financial service company and investment bank holding a history of 154 successful years.

Last year HSBC bank was declared as the 7th largest bank with US$2.558 trillion assets. HSBC has implemented the open banking interface that enables third parties i.e Financial Institutes, access to the bank’s data, leverage the bank’s networks, and create applications for their clients.

Open Banking avails transparency to the bank’s clients, bank owners, and entrepreneurs, availing various opportunities.

What is Open Banking and how does HSBC implements the Open Banking API?

So if you are not familiar with what API is , then you will ask what makes Open Banking API one of the crucial Fintech trends of current time. Well, then here is your answer. It is a mechanism to create an ecosystem that solves needs, conducts businesses, and suggests services. On top of that the customer’s account details are shared with third party financial institutes or other banks that can build more useful applications for the same customers.

This year in September, HSBC launched its first New Banking Guarantee API through which their customers’ supplier is assured to get payment for exchanged goods or services, if not via customer, then directly via the customer’s HSBC bank.

Benefits of Using Open API

- Bank services such as loans, transfers, advice, finance, etc. are centralized and well administered.

- Makes it easy for customers to automate and quickly access different Financial services.

Near Field Communications NFC

PayPal

PayPal is an online money transfer company that provides an alternative to the traditional check and money orders processes. A PayPal account often called the PayPal Wallet, is a digital wallet that enables account holders to make payments without actually handing out their credit/debit cards, simply using the contactless Near Field Communication NFC payment method.

What is NFC and how does it work in the PayPal app?

Near Field Communication technology is a short-range communication between compatible devices where one can receive and the other one can transmit signals. This technology is used to transfer money or account balance via smartphones without using ATM cards.

NFC works on the principle of transmitting radio waves just like Bluetooth and WiFi. NFC uses Radio Frequency identification RFID tags that use electromagnetic induction to transmit information.

The PayPal app avails the “tap and pay” option that enables money transfers or bill payments on the mere tap of phones while the app is functioning.

The speed and convenience of NFC based payment is what made it one of the most talked FinTech trends in the last 8-10 Years.

Benefits of using NFC Technology

- NFC resolves the biggest issue of digital payment, the speed. With NFC payment is faster than paying via cash. In fact currently, it is the fastest mode of payment.

- Mobile based NFC is more secure than Cash or Credit card as it utilizes the inbuilt security and hardware of the modern smartphones.

Startups should be cautious about the following points

- In order to accept payment via NFC, the store requires a dedicated reader and a software. So startups might find a hard time to convince the merchants to install this dedicated harware.