Introduction

Today almost every industry vertical from BFSI, retail and eCommerce, media and entertainment, travel and hospitality is predominantly using payment gateways to manage high volumes of online transactions seamlessly and efficiently. Payment gateway API integration is the process of embedding a payment application programming interface into a website, software system, or mobile application to enable the acceptance and processing of payments. Payment gateway integration using API development services allows businesses to access real-time analytics and reporting, which help in making informed decisions and optimizing their financial operations. API integrations also authorize and process payments and receive notifications or updates regarding transaction statuses.

Main Actors

01

Merchant or the Business Owner

The merchant is the primary actor here who must integrate the payment gateway into their website or application to receive payments. They must ensure that their platform is fully prepared and compatible for a seamless API integration. They are required to give necessary business and financial details, manage online transactions, and handle customer services related to payments.

02

The Customer

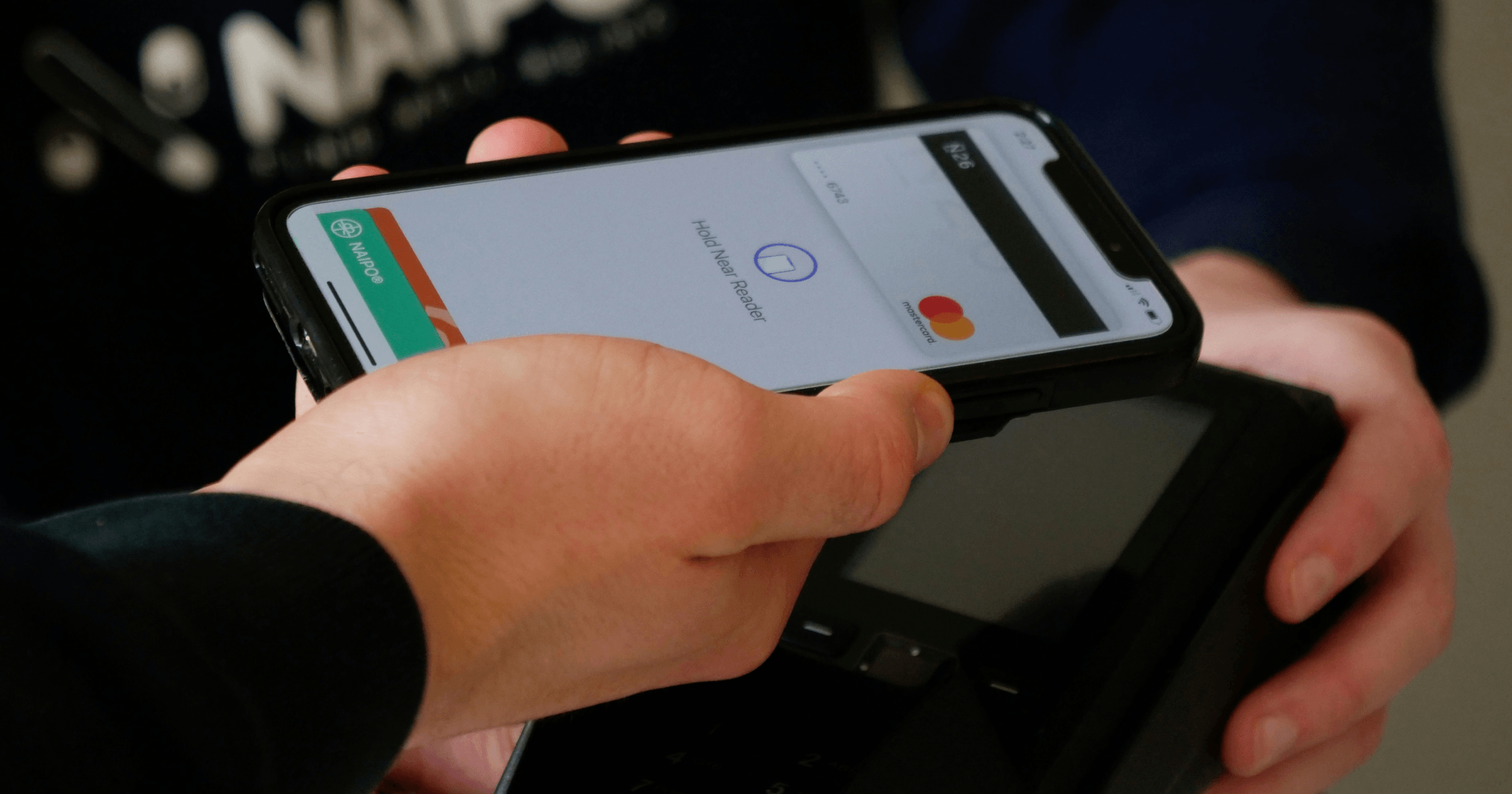

They interact with the payment gateway while making a purchase or paying for any service. They have to select the right payment method, enter the essential details, and authorize the transaction process. Today customers expect a user-friendly, smooth, and secure payment process.

03

Payment Gateway Provider/Processor

They are mainly third-party service providers facilitating the transaction between the customer and the merchant’s bank. They are responsible for securely processing payment requests, ensuring sufficient funds are available, and transferring the money into the merchant account. They must comply with payment regulations based on the specific region.

04

API Developers

The API developers are professionals responsible for the technical implementation of the payment gateway. They develop and integrate the payment API into the merchant’s system, ensuring it works seamlessly with the existing architecture. They also handle testing, debugging, and deploying the integration.

05

Bank or Financial Institution

The entity helps to carry out the financial transactions securely and smoothly, verifying the fund's availability, approving or declining the transactions, and managing the transfer of money from the customer to the merchant’s account. They also handle all types of transaction disputes and identify fraud detection.

Pre-Conditions

Setting up the Merchant Account

The first and foremost step is setting up a registered merchant account with the selected payment gateway provider. The process involves simplified onboarding and submitting the necessary business details, and other vital information mandatory for identity verification and linking up the bank account. Account setup is indispensable to receive payments and access the gateway’s features.

API Key and Secret Acquisition

The merchant needs to obtain unique API keys and secrets from the payment gateway provider. These credentials are critical for authenticating requests between the merchant’s platform and the payment gateway. Without valid API keys, the system cannot securely process transactions or interact with the gateway.

Compliance with PCI DSS

The merchant’s website or application must comply with the Payment Card Industry Data Security Standard (PCI DSS). This involves implementing robust security measures such as data encryption, secure storage, and regular security audits to protect cardholder data. Non-compliance can lead to hefty fines and loss of the ability to process payments.

SSL Certificate Installation

To ensure that all payment-related data is transmitted securely, the merchant’s platform must have a valid SSL certificate installed. This encryption standard protects sensitive information during transmission, making it inaccessible to unauthorized parties. An SSL certificate also builds customer trust by displaying a secure connection (HTTPS).

Sandbox Environment for Testing

A sandbox or testing environment must be configured to allow developers to test the integration without affecting live transactions. This environment mimics the live environment, enabling thorough testing of API requests, error handling, and overall payment processing functionality before going live.

Platform Stability and Compatibility

The merchant’s platform must be stable and compatible with the payment gateway API integration. This includes ensuring that the server infrastructure can handle the API requests and responses efficiently without causing delays or errors during peak transaction periods.

Post-Conditions

Successful Transaction Processing

After processing the transaction, the payment gateway AP provides immediate confirmation to the customer and merchant through email or SMS. They receive real-time updates on the transaction’s status to ensure the process was completed successfully

Secure Storage of Transaction Data

Payment gateway integration allows all transaction data, including customer payment details and transaction history, to be securely stored in compliance with PCI DSS and other relevant regulations. This involves encryption, tokenization, and secure backups, ensuring that sensitive data is protected from breaches and unauthorized access.

Automated Settlement of Funds

Upon successful payment processing, the funds from the customer’s account are automatically transferred to the merchant’s account, minus any fees charged by the payment gateway. This settlement process is typically automated within a predefined time frame, ensuring smooth financial operations.

Real-time Analytics and Reporting

The system should automatically update and provide real-time analytics and reporting on all processed transactions. This includes detailed reports on sales, payment methods used, transaction statuses, and any errors encountered. These insights help merchant monitor their financial performance and make informed business decisions.

Enhanced Fraud Detection and Security Measures

The payment gateway continuously monitors transactions for fraudulent activities using advanced algorithms and machine learning. If a transaction is flagged as suspicious, it is either blocked or subjected to additional verification, protecting the merchant and customers from potential fraud.

Compliance Logging and Audit Trails

All transactions, including their statuses, errors, and exceptions, are logged for audit purposes. These logs are essential for compliance with financial regulations and are used during internal audits, dispute resolutions, and for improving the payment process

Customer Support and Dispute Resolution

In cases where customers face issues with payments, the system should facilitate easy access to customer support. This includes automated emails with support contact information and a streamlined process for dispute resolution, ensuring that any payment-related issues are resolved promptly.

Main Flow

Alternative Flow

- Insufficient Funds - If the customer’s account does not have sufficient funds to make the purchase, the payment gateway API will show a decline response. The system informs the customer regarding the issue to take appropriate action, such as choosing a different payment method or contacting their bank.

- Internet Network Disruption - The payment may fail or get declined due to internet disconnection. In such a case, the system tries to reattempt the payment. If the issue persists, the customer gets a notification to try and make the payment later, ensuring that they are not left in uncertainty.

- Invalid Card or Payment Information - If the customer enters incorrect payment information, wrong card number, or CVV, the payment gateway API will reject the transaction. The system sends an immediate error message, prompting the customer to enter the correct details and check the information before making the payment.

- Exceeding the Spend Limit - If the customer attempts to make a payment from the card that allows them to spend a fixed amount the payment gateway API will instantly decline the transaction. It sends a notification to the customer, informing them that they are exceeding the spending limit. They have to either choose another payment option or reduce the amount.

- Do Not Honor - If the customer’s bank does not honor the payment during the payment authorization process, the transaction is automatically declined by the payment gateway. Upon payment failure, the customer is asked to contact the bank or use an alternate payment method. The transaction is recorded as unsuccessful, and no funds are transferred.

Conclusion

Payment gateway API integration has allowed diverse industries and businesses to streamline and optimize online transactions efficiently and securely. Payment gateway integration has also amplified customer experiences with improved trust and satisfaction by real-time payment processing. It also ensures compliance with the industry standards and regulatory requirements. Businesses are required to choose the right payment gateway provider and processor, while API integration services help in implementing payment gateway.

Suggested TechStack

They play a vital role in enabling seamless communication between the payment gateway and the merchant system. RESTFul APIs enhance flexibility and scalability to efficiently manage real-time payment requests and responses.

They are used for authentication and authorization. OAuth 2.0 ensures that only authorized users and applications can access the payment gateway, securing sensitive data from unauthorized access.

JavaScript frameworks like ReactJS or AngularJS are used to create responsive, user-friendly front-end interfaces for the payment process. They enhance the customer experience by providing smooth transitions and real-time feedback during the payment process.

Node.js with Express is ideal for building the back-end services that handle API requests, manage transactions, and process payment data. It offers high performance and scalability, making it suitable for handling high volumes of transactions.

Optimize Your Online Transactions with Seamless Payment Gateway Integration

Leverage expert API development services to enhance payment security and efficiency